Fast onboarding

Enable users to open accounts in under 5 minutes—reducing abandonment and accelerating deposit growth.

Instant funding

Boost activation and engagement by offering immediate funding via ACH or debit/credit card.

Real-time KYC

Automate identity checks, perform device risk scoring, and screen OFAC watchlists during onboarding to lower fraud risk.

Mobile-first design

Turn mobile traffic into completed accounts.

With 80% of applicants starting on mobile, Valiify’s responsive, app-like experience reduces drop-off and drives more successful account openings—anytime, anywhere.

Pre-filled applications

Less typing, more completing.

Using trusted third-party data, Valiify pre-fills application fields to reduce friction, minimize errors, and accelerate time to open.

Dynamic workflows

Tailored to your process, not the other way around.

Customizable, modular workflows adapt to your institution’s unique requirements, cutting unnecessary steps and speeding up onboarding.

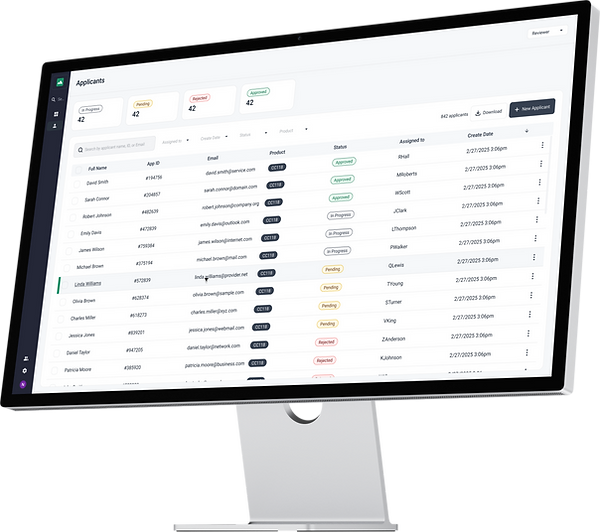

Compliance dashboard

Stay in control, stay compliant.

Easily manage identity exceptions, document checks, and regulatory tasks from a centralized dashboard, reducing manual effort and simplifying audits.

Intent-based cross-sell

Increase product adoption from day one.

Valiify’s AI recommends the right add-ons—like debit cards, overdraft protection, and more—based on each applicant’s intent, helping deepen relationships early.