Why Account Opening Automation is a Must for Modern Banks and Credit Unions

- Jonathan BenAmoz

- Jul 9, 2025

- 4 min read

Updated: Jul 15, 2025

Account opening automation transforms how banks and credit unions onboard new customers by replacing paperwork and branch visits with a fast, fully digital experience. For both retail and business clients, it simplifies and accelerates onboarding, reducing friction and delays through smart, automated workflows. As digital banking rapidly evolves, account origination must keep pace—delivering streamlined, compliant, and user-centric experiences right from the first interaction.

1. Faster Digital Onboarding Boosts Account Origination

In the world of account opening automation, speed is a competitive advantage. Today’s banking customers—accustomed to the instant gratification of e-commerce and streaming—expect the same seamless experience from their financial institutions. Automated onboarding workflows drastically reduce account origination time, transforming a process that once took days into one completed in minutes.

“Digital account opening can reduce onboarding time by over 80% compared to traditional methods.” – McKinsey

By eliminating friction, banks and credit unions significantly lower abandonment rates.

“Up to 70% of applicants abandon account opening processes that are too long or complex.” – Forrester

Faster onboarding not only improves conversion rates but also increases early engagement and lifetime value, especially among digital-first consumers and small business clients.

2. Lower Operational Costs

Traditional account origination methods rely heavily on manual tasks like paperwork, branch visits, and data entry—making the process labor-intensive and costly. These outdated workflows not only drive up operational expenses but also increase the likelihood of human error.

Account opening automation solves these challenges by digitizing and streamlining onboarding from start to finish. By reducing the need for in-branch staff, eliminating paper processing, and minimizing error correction, financial institutions can achieve significant cost savings. These savings can then be redirected toward digital transformation, enhanced customer service, or strategic growth initiatives.

3. Automation Enhances Compliance and Risk Management

With financial regulations such as KYC, AML, and fraud prevention growing more complex, account opening automation plays a critical role in maintaining consistent compliance. Automated onboarding incorporates tools like digital ID verification, real-time risk scoring, and document scanning directly into the account origination workflow—reducing human error and ensuring every applicant meets regulatory standards.

This automation not only minimizes exposure to audits and penalties but also enhances fraud detection and risk management—safeguarding both the institution and its customers.

“Nearly 96% of banks and credit unions plan to adopt AI-powered onboarding tools in the next five years.” – Alkami Data Bites

4. Enhanced User Experience

Modern consumers expect fast, mobile-optimized service from their financial institutions. With account opening automation, banks and credit unions can eliminate friction points like printing forms or waiting days for approval. Instead, applicants enjoy a seamless digital journey—with features like document uploads, e-signatures, and real-time ID verification—all within an intuitive, app-like interface.

This elevated user experience drives higher completion rates, promotes referrals, and strengthens brand loyalty.

“Financial institutions that offer fully digital account opening see up to 20% higher conversion rates.” – Javelin Strategy & Research

5. Scalability Without Growing Headcount

One of the most valuable benefits of account opening automation is its ability to scale without increasing headcount. Banks and credit unions can manage high-volume account origination during new campaigns, market expansions, or seasonal surges—without added strain on operations.

Automated onboarding workflows maintain speed and consistency even during peak demand, giving financial institutions a competitive edge by enabling growth without the cost and complexity of hiring, training, or shifting internal resources.

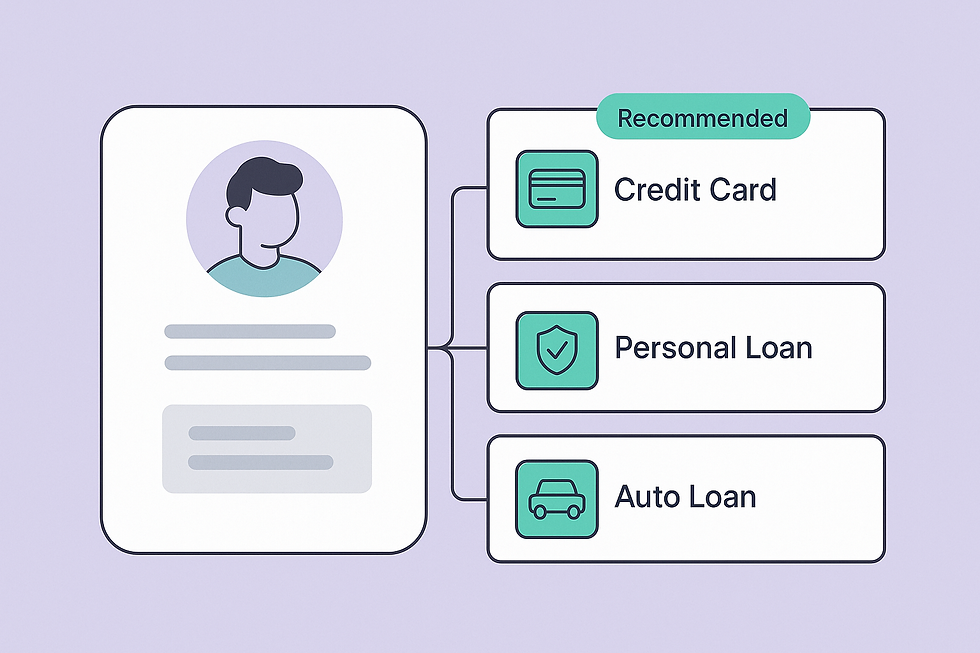

6. Cross-Sell and Personalization Opportunities

Automated account opening does more than onboard new users—it gathers valuable insights. Financial institutions can leverage this data to offer personalized products and services, such as:

Debit or credit cards

Overdraft protection

ACH origination and Positive Pay for businesses

Mobile banking enhancements

These tailored offers increase early engagement and product adoption, laying the foundation for long-term customer loyalty and maximizing lifetime value—starting from day one.

Final Thoughts: Account Opening Automation as a Growth Driver

Account opening automation isn’t just a technology upgrade—it’s a strategic growth driver for modern financial institutions. By cutting operational costs, improving compliance, enhancing user experience, and enabling scalable account origination, banks and credit unions position themselves to lead in an increasingly digital marketplace.

As customer expectations continue to rise, those institutions that embrace automation will not only meet demand—they’ll define the future of digital banking.

Contact us to learn more about our digital account opening solution here.

Frequently Asked Questions: Account Opening Automation

1. What is account opening automation in banking?

Account opening automation is the use of digital technology to simplify and accelerate the process of opening new bank accounts. It replaces manual paperwork, branch visits, and back-and-forth with a seamless online or mobile experience—often enabling users to open and fund an account in just minutes.

2. How does automated account opening improve customer experience?

It offers a fast, intuitive, and mobile-friendly onboarding experience that mirrors what users expect from other digital services. Features like real-time identity verification, e-signatures, and instant account funding reduce friction and increase satisfaction.

3. Is account opening automation secure and compliant?

Yes. Leading solutions incorporate built-in tools for KYC, AML, and fraud prevention. Automated workflows ensure every applicant is screened using consistent, up-to-date compliance protocols—reducing the risk of human error and regulatory fines.

4. Can automation help reduce application abandonment?

Absolutely. Slow or cumbersome processes are a major reason for drop-off during account opening. By streamlining steps and reducing time to open, automation significantly lowers abandonment rates and boosts conversion.

5. What types of accounts can be opened with automation?

Automation can be used for a variety of accounts, including checking, savings, certificates of deposit (CDs), and small business accounts. Some platforms also support multi-product enrollment and cross-sell during the onboarding flow.

Comments